SIAM Suggests GST Rates For Automobiles To Govt

SIAM feels GST rates for automobiles need to be looked at more sensitively and has made some suggestions in this regard

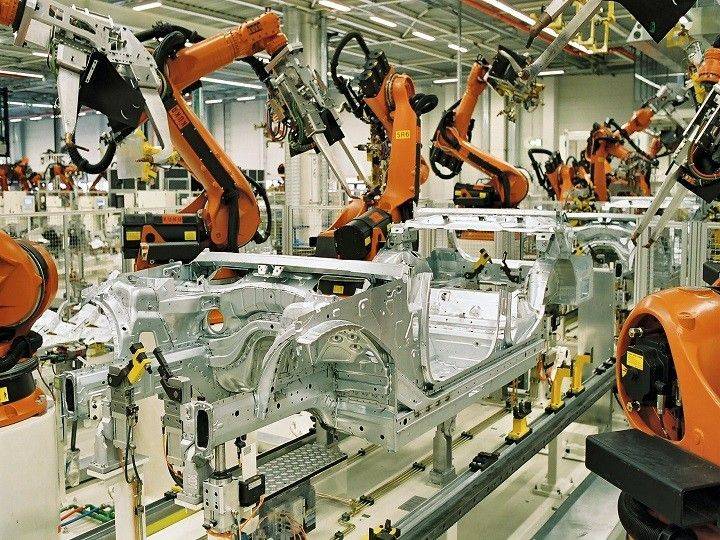

The Society of Indian Automobile Manufacturers (SIAM) represents the automotive industry in India and it has joined hands with the Indian government. Due to this collaboration, the auto industry will jump from BS-IV to BS-VI emission standards by 2020. New safety features will also be added to the vehicles. Both these developments are bound to have huge cost implications for OEMs, and so the need for GST.

SIAM has suggested that GST rates for automobiles should be looked at more sensitively. Why? For a long time, there were only two excise duty rates for passenger cars. However, today, we have four rates which come after we exclude the rates for electric and hybrid electric vehicles. So, the body has suggested the following:

- Standard GST rate should be applicable on small cars, MUVs, two-wheelers, three-wheelers and commercial vehicles.

- Cars other than small ones should attract a GST rate that's 8 per cent more than the standard rate.

- A lower GST rate for electric vehicles, hybrid electric vehicles and other alternative fuel vehicles, which should be at least 8 per cent less than the standard rate.

No comments: